IR Basic Policy

1.Basic Concept Regarding IR

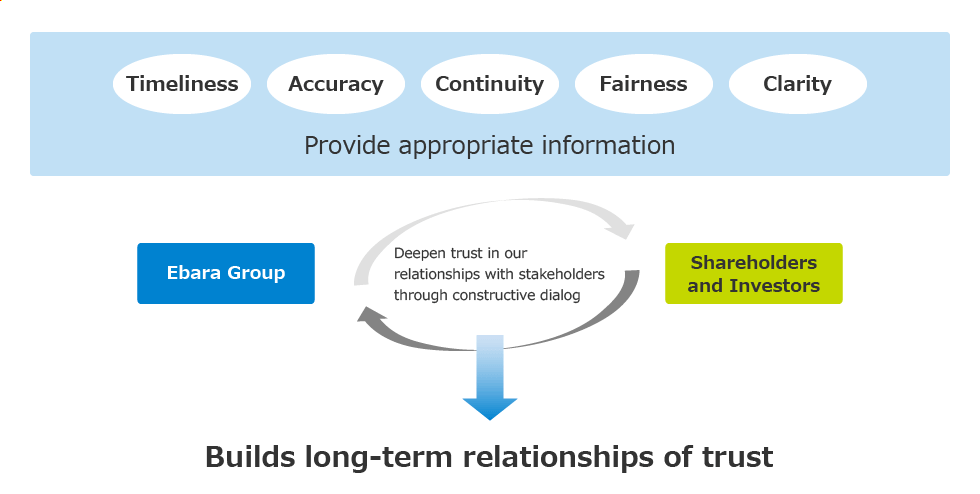

The Company recognizes the development of a long-term trusting relationship with shareholders and investors as one of the most important aspects of management. The Company provides the appropriate corporate information necessary for shareholders and investors to make investment decisions, and works to deepen trust in our relationships with stakeholders on a continuous basis by engaging in IR activities aimed at enhancing corporate value through constructive dialog.

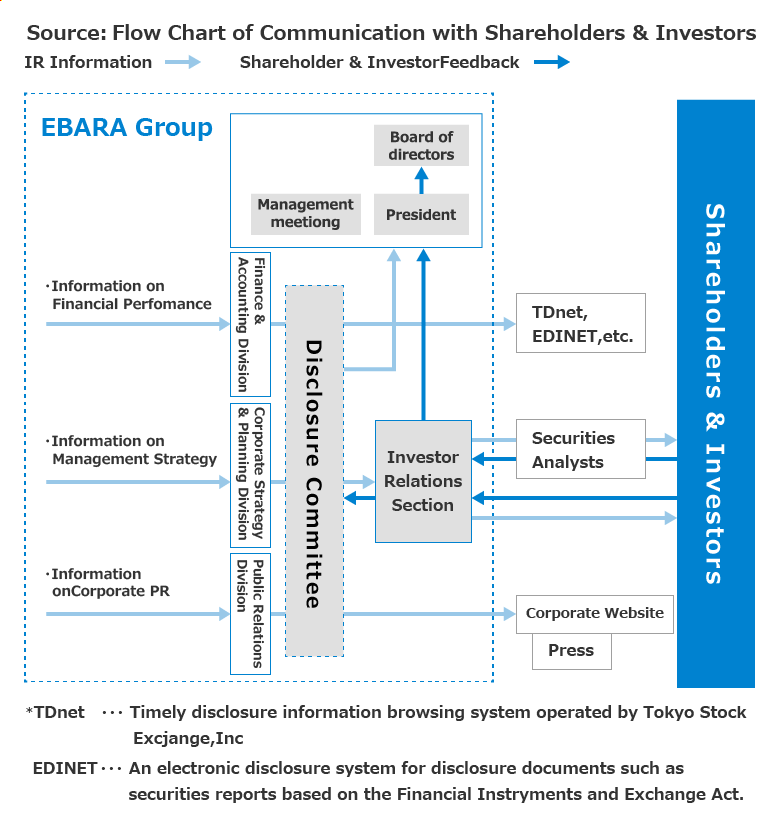

2.Internal Structure for Information Disclosure

The EBARA Group IR structure is managed by the executive officer responsible for IR and the Investor Relations Section, which is under the direct control of the President. Together, they handle all IR activities. The Investor Relations Section shall also arrange opportunities for directors (including outsider directors), executive officers and other top management to engage in direct dialogs with shareholders and investors as necessary.

EBARA has established internal procedures to identify all information that should be disclosed without omission, and make decisions on the specific content to be disclosed and the timing of disclosure.

3.Method of Information Disclosure

Information to which the Timely Disclosure Rules of the Tokyo Stock Exchange apply shall be disclosed through the system operated by the Tokyo Stock Exchange. The same information will be posted on the Company website without delay, after disclosure.

EBARA will actively disclose information deemed valuable for shareholders and investors through the Company website and other means even in cases where such information is not subject to the Timely Disclosure Rules.

4.Management of Material Information, etc.

Scope of Material Information

The EBARA group deems the following types of information as material information that could materially affect the investment decisions made by investors, based on the governing laws and regulations: Information subject to insider trading regulations and final financial results information of the EBARA Group that have not yet been disclosed.

Handling of Material Information

When engaging in dialog with shareholders and investors, EBARA makes sure that the relevant individuals in the EBARA Group fully understand the intent of the rules on fair disclosure in advance. We also make certain that material information is not disclosed selectively by having a representative from the Investor Relations Section sit in on the conversation, when necessary.

If it is found that information thought to be material information has been disclosed without first being publicly disclosed, the internal division responsible for this information will discuss the matter and promptly disclose the information on the Company website if it is determined to be material information. However, if public disclosure of the information is determined to be inappropriate, the division may temporarily refrain from disclosing the information, to the extent permitted under related laws and regulations.

Handling of Insider Information

To prevent leakage of insider information, EBARA has established and complies with the “Regulations on Prevention of Insider Trading.” In addition, staff members in the Investor Relations Section are required to undergo external training in a separate course concerning handling of material facts. When staff members of other divisions have dialogs with shareholders or investors, the Investor Relations Section cautions them on the handling of material facts in advance to ensure strict control over insider information and prevent potential leaks.

5.Forward-Looking Statements

Of the information disclosed by EBARA, forward-looking statements such as those relating to earnings forecasts and other projections reflect the assumptions formed by the Group based on limited information available at the time. Such information includes potential risks and uncertainties. For this reason, actual business results and other outcomes may differ from these forecasts due to various factors. Key factors that may affect actual business results include, but are not limited to, the state of the global economy, fluctuations in exchange rates, and the market environment.

6.Silent Period

EBARA mandates a silent period from the day following the last day of each quarter until the announcement of financial results in order to prevent any leaks of financial closing information and to maintain impartiality. During this period, EBARA shall refrain from answering questions related to the relevant financial results.

7.Initiatives to Enhance IR Activities

In IR activities, EBARA proactively creates opportunities to engage in dialogs with stakeholders and investors through various means to increase their understanding of EBARA’s business and respond to their diverse needs. These opportunities include one-on-one meetings, mainly for institutional investors; quarterly briefings on financial results; business briefings and plant tours for all investors including individual shareholders; and provision of information via the Company website or reports to shareholders. The EBARA Group has also built a system that allows the Group to share information and insights gained from dialogs with shareholders and investors, and utilizes these in corporate management.