Compensation for Directors and Executive Officers

Policy on Compensation

Compensation for Directors

- (1)

Non-executive Directors (including Independent Directors)

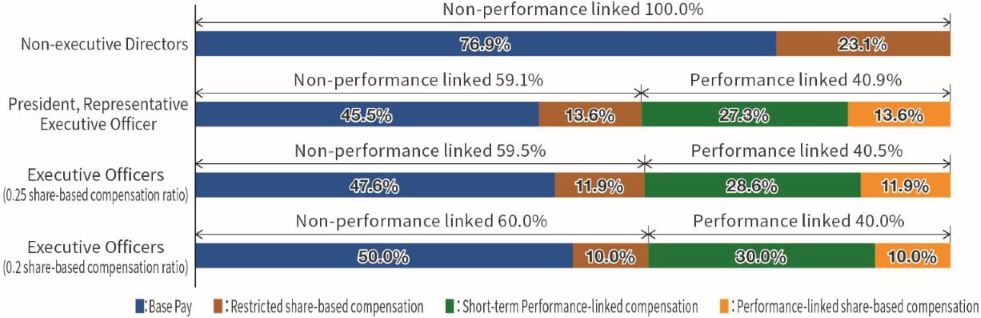

Compensation for Non-executive Directors comprises basic compensation and long-term incentive, since they are expected to take on the role and responsibility of supervision from a standpoint that is independent from business execution to see that business execution is carried out lawfully, and it is determined by the Compensation Committee. The long-term incentive shall be in the form of restricted share-based compensation (RS) to promote the sustainable improvement of corporate value and to encourage the Directors to share values with shareholders through the ownership of shares. Furthermore, the Company pays allowances to the Chairperson of the Board of Directors, the Lead Independent Director, and the Chairpersons of the Committees based on the extent of their roles and responsibilities and the number of hours spent on their execution of duties.

- (2)

Executive Directors

The Company pays compensation as Executive Officers to Executive Directors concurrently serving as Executive Officers, and does not pay them compensation as Directors.

- (3)

- Combination of Compensation

The combination of Directors’ compensation is as follows.

| Monetary pay | Share based Compensation (Long-term incentives) | |||

|---|---|---|---|---|

| Basic compensation | Short-term Performance-linked Compensation | Restricted stock compensation | Performance-linked stock compensation | |

| Non-executive Directors (including Independent Directors) | 1.0 | ー | 0.3 | ー |

The above figures show the ratio of compensation for Directors, not the amount actually paid to each Director.

Compensation for Executive Officers

- (1)

- Compensation SystemCompensation for Executive Officers is designed to encourage Executive Officers to perform their duties in accordance with the management philosophy and management strategies and to strongly motivate them to achieve challenging management targets with appropriately controlled risks. The compensation for Executive Officers comprises basic compensation according to the role of President and Representative Executive Officer or each Executive Officer, a short-term performance-linked compensation, restricted stock compensation, and performance-linked stock compensation, and is determined by the Compensation Committee. As the Executive Officers are expected to play key roles in the achievement of numerical targets in their business execution, the compensation system is designed that the portion of the short-term performance-linked compensation may be larger than the portion of the basic compensation if performance targets are achieved.

- (2)

- Combination of Different Types of CompensationThe combination of different types of compensation for Executive Officers is as follows.

| Monetary pay | Share based Compensation (Long-term incentives) | |||

|---|---|---|---|---|

| Basic compensation | Short-term performance-linked compensation* | Restricted stock compensation | Performance-linked stock compensation* | |

| President and Representative Executive Officer | 1.0 | 0.6 | 0.3 | 0.3 |

| Executive Officers | 1.0 | 0.6 | 0.2 - 0.25 | 0.2 - 0.25 |

The above figures show the ratio of compensation for Executive Officers, not the amount actually paid to each Executive Officer.

Short-term performance-linked compensation is paid within the range of 0 to 200% based on the level of achievement of companywide performance targets and the individual performance targets of each Executive Officer.

Performance-linked compensation is paid within a range of 0 to 200% based on the level of achievement of performance targets.

- (3)

Compensation Levels

The basic compensation is aimed at a level that is comparable with competing companies assumed to have similar businesses and human resources (hereinafter referred to as “Peers”). The compensation levels of domestic Peers’ shall be regularly checked and, at the same time, compensation levels according to the roles of each Executive Officer shall be adjusted and determined with attention also given to employees’ compensation levels (such as disparity with officers, deviation from publicly accepted levels).

By implementing these measures, the level of total compensation (the sum of the basic compensation, short-term performance-linked compensation, restricted stock compensation, and performance-linked stock compensation) for Executive Officers of the Company shall be designed to be higher than the level of domestic Peers if the targets of strategies and business performance have been successfully achieved and be lower than the compensation level of officers of domestic Peers if such performance targets fail to be achieved.

Composition of Compensation Paid to Directors and Executive Officers

(If 100% of the target for performance-linked compensation is achieved)

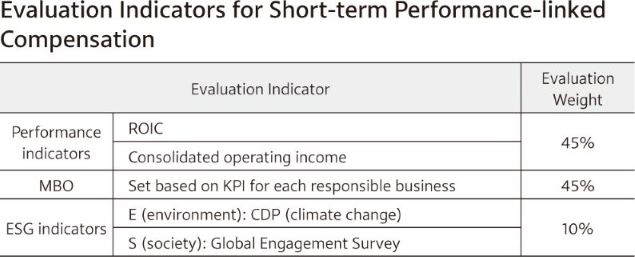

Introduction of ESG Indicators to Short-Term Performance-Linked Compensation

*2. Since 2019, employees of domestic and overseas Group companies have been participating in the Global Engagement Survey to investigate the current state of engagement in their companies and workplaces to achieve their medium- to long-term visions.

Long-term Incentives (Share-Based Compensation)

(a)Restricted Stock Compensation(RS)

As a principle, certain numbers of restricted shares will be given to Corporate Officers and subsidiaries corresponding to their roles per year. Because the objectives are to promote shareholding by Corporate Officers, and increase value sharing with shareholders, the transfer restricted period is from the share giving date to the day of retirement; thus the transfer restriction will be released when he/she retires from the position of Corporate Officers.

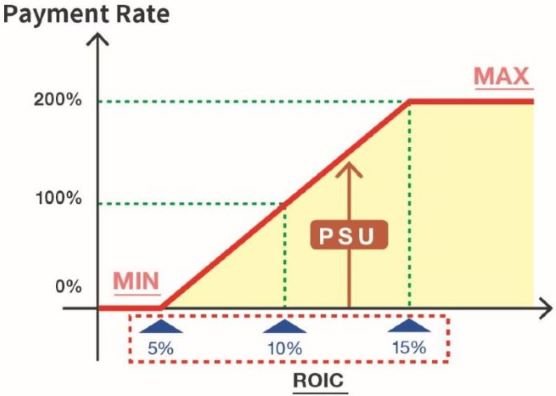

(b)Performance-linked Stock Compensation (PSU)

Depending on the degree of achievement of the ROIC target (15%) for the fiscal year ended December 31, 2025, the final year of the medium-term management plan E-Plan 2025, the payment rate is 0% to 200%.

Method of calculation of the number of shares for payment and individual payment amounts

・Number of performance-linked stock compensation payments by shares (rounded down to the nearest whole unit)

Standard number of units × payment rate × 60%

(1 unit = 100 shares of the Company’s common stock)

・Payment amount of number of performance-linked stock compensation by money (rounded down to the nearest 100 yen)

Standard number of units × payment rate × 40% × share price of our common stock*

(1 unit = 100 shares of the Company’s common stock)

*Simple average of the closing price of our common stock in regular trading on the Tokyo Stock Exchange in the two months preceding the month in which the meeting of the Board of Directors to resolve the allotment for the final year of the medium-term management plan is held.

*Reflecting the result of share split (1:5) made effective as of July 1, 2024.

Payment rate

Payment rate (%) = Consolidated return on invested capital (ROIC) × 20-100

The second demical place shall be rounded off to the first decimal place. However, if the calculation result is less than or equal to 0% the rate shall be 0% (not paid), and if the calculation result exceeds 200%, the rate shall be 200%.

Consolidated return on invested capital (ROIC) = NOPLAT (Net Operating Profit Less Adjusted Taxes) ÷ Invested capital {Interest-bearing debt (average between the beginning and end of fiscal year) + Equity attributable to owners of parent (average between the beginning and end of fiscal year)}

Payment rate according to level of achievement of ROIC

(6)Matters Related to Independent Directors

- 1)

Important other positions held concurrently and their relationship with the Company

As stated in the table, “(2) Names and other information on Directors and Executive Officers.”

- 2)

- Specific relationships with major business partners and others

None.